The Best Software for Wealth Management in 2024

The digital landscape is transforming at a breakneck speed, and managing one's wealth has never been more significant. With the advent of innovative software for wealth management, individuals are now able to effectively manage their finances, investments, and budgets. In this comprehensive guide, we will delve into the top software solutions available to wealth managers in 2024.

Table of content

Table of Contents

We’re on board to help with your product. Don’t hesitate to get in touch.

Contact Us Let’sTalk

The digital landscape is transforming at a breakneck speed, and managing one’s wealth has never been more significant. With the advent of innovative software for wealth management, individuals are now able to effectively manage their finances, investments, and budgets. In this comprehensive guide, we will delve into the top software solutions available to wealth managers in 2024.

The Rise of Wealth Management Software

In the era of rapid technological advancements, wealth management has evolved from traditional methods to a more sophisticated and personalized approach. The use of software for wealth managers facilitates comprehensive financial oversight, automates investment strategies, and provides valuable insights into income and expenditure.

Key Features of Wealth Management Software

Wealth management software comes packed with a multitude of features designed to aid in financial management. These features encompass:

- Income and expenditure tracking: These software solutions provide a comprehensive overview of your income and expenditure, enabling you to manage your finances effectively.

- Bank account connectivity: The ability to connect to your bank accounts and credit cards allows for automatic transaction downloads and real-time financial updates.

- Financial goal-setting: This feature empowers wealth managers to track cash flow across multiple financial accounts and set achievable financial goals.

- Investment management: Automated investment features, risk assessment, and tailored advice are part and parcel of these software solutions.

Top Software Solutions for Wealth Management in 2024

Now that we’ve established the importance and key features of wealth management software, let’s dive into some of the top solutions available in 2024.

Empower: Comprehensive Software For Wealth Management

Empower stands out as a comprehensive tool for wealth accumulation, retirement planning, and fee analysis. It provides an extensive suite of tools, facilitating a visual financial overview and easy account tracking.

Key Features:

- Visual financial overview: Empower offers an engaging interface, providing a comprehensive financial overview.

- Account linking: It allows seamless linking of all your financial accounts for easy tracking.

- Wealth building and retirement planning tools: These tools assist in wealth accumulation and future financial planning.

- Fee analysis: This feature aids in identifying potential savings by analyzing various fees.

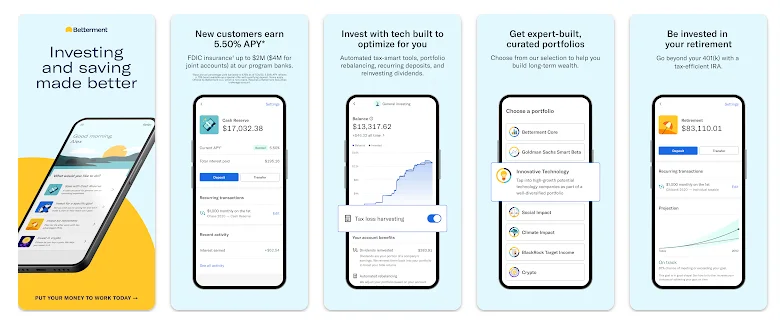

Betterment: Automated Investing

Betterment, a popular robo-advisor, streamlines the investment process with its automated investment platform. Its user-friendly interface and goal-based investing features make it an ideal choice for those who favor an automated approach to investing and wealth management.

Key Features:

- Automated portfolio management: Betterment offers automated portfolio management, reducing the need for manual intervention.

- Risk assessment and financial planning: The software assesses risk and offers financial planning tools.

- Tailored advice and recommendations: Betterment provides personalized advice in line with individual goals and risk tolerance.

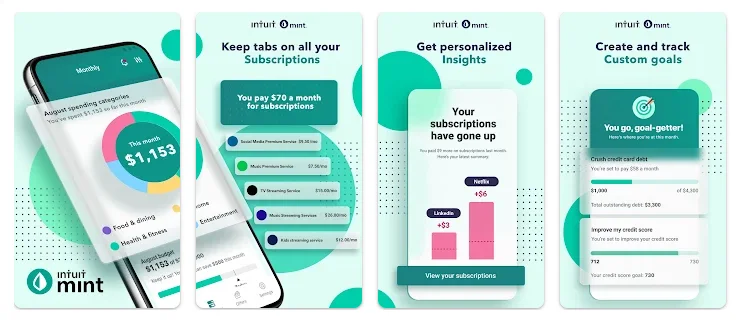

Mint: Software for Wealth Management – Budgeting and Wealth Tracking

Mint stands out as a comprehensive budgeting app that integrates wealth tracking features. It provides a detailed overview of your financial health while assisting in comprehending spending patterns and establishing personalized budgets.

Key Features:

- Financial goal tracking: Mint allows users to track financial goals, providing a holistic view of their financial journey.

- Expense tracking and categorization: This feature offers insights into spending habits and helps manage expenses effectively.

- Credit score access: Mint allows users to access their credit scores, providing an additional layer of financial insight.

Honeydue: Tailored for Couples

Honeydue is an innovative wealth management software app designed specifically for couples. It integrates financial organization and collaboration, allowing partners to efficiently manage their finances and strategize for the future.

Key Features:

- Financial overview for couples: Honeydue provides a streamlined financial overview tailored for couples.

- Account synchronization: This feature allows for comprehensive tracking of all financial accounts.

- Expense analysis: Honeydue’s expense analysis feature helps optimize spending.

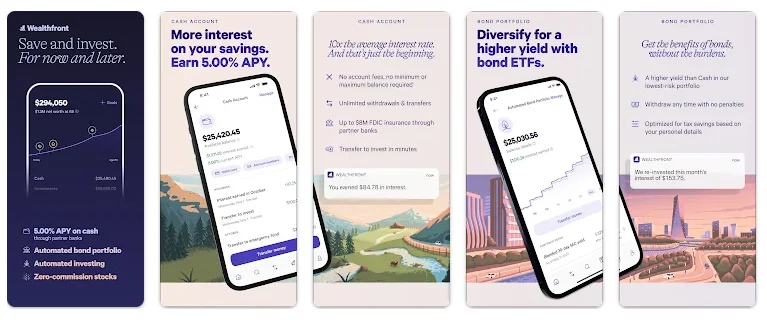

Wealthfront: Simplified Investment Process

Wealthfront is a leading robo-advisor and wealth management software app that streamlines and automates the investment process. It focuses on constructing diversified portfolios and optimizing investments for long-term growth.

Key Features:

- Automated portfolio management: Wealthfront automates portfolio management, allowing for hands-off investment.

- Goal-oriented investing: The software enables users to define their financial goals, managing and rebalancing their portfolio accordingly.

- Tax-efficient strategies: Wealthfront utilizes advanced algorithms to offer tax-efficient investment strategies.

Choosing the Right Software for Wealth Management

Selecting the ideal wealth management software is a process that should be guided by your specific needs and objectives. Whether you’re focusing on budgeting, investment tracking, or automated investing, evaluating the specific features and pricing of each software before making a decision is crucial.

Conclusion

Wealth management software has become an indispensable tool in the arsenal of individuals and wealth managers alike. As technology continues to advance, these software solutions promise to offer even greater innovation and personalization. By staying informed about the latest developments and trends, you can ensure that you’re making the most of these powerful tools to manage finances and build wealth effectively.